Dental Billing - RCM Solutions

For Single Practices, Dental Groups, and DSOs

We assist dental organizations in surpassing revenue and growth targets by eliminating redundant administrative tasks.

MediDental's Dental Revenue Cycle Management Solutions assume responsibility for tasks that typically tie up your staff on the phone or in front of computers, enabling them to concentrate on patient interaction. Let MediDental eliminate a hindrance to growth and profitability with our comprehensive suite of Dental RCM Solutions.

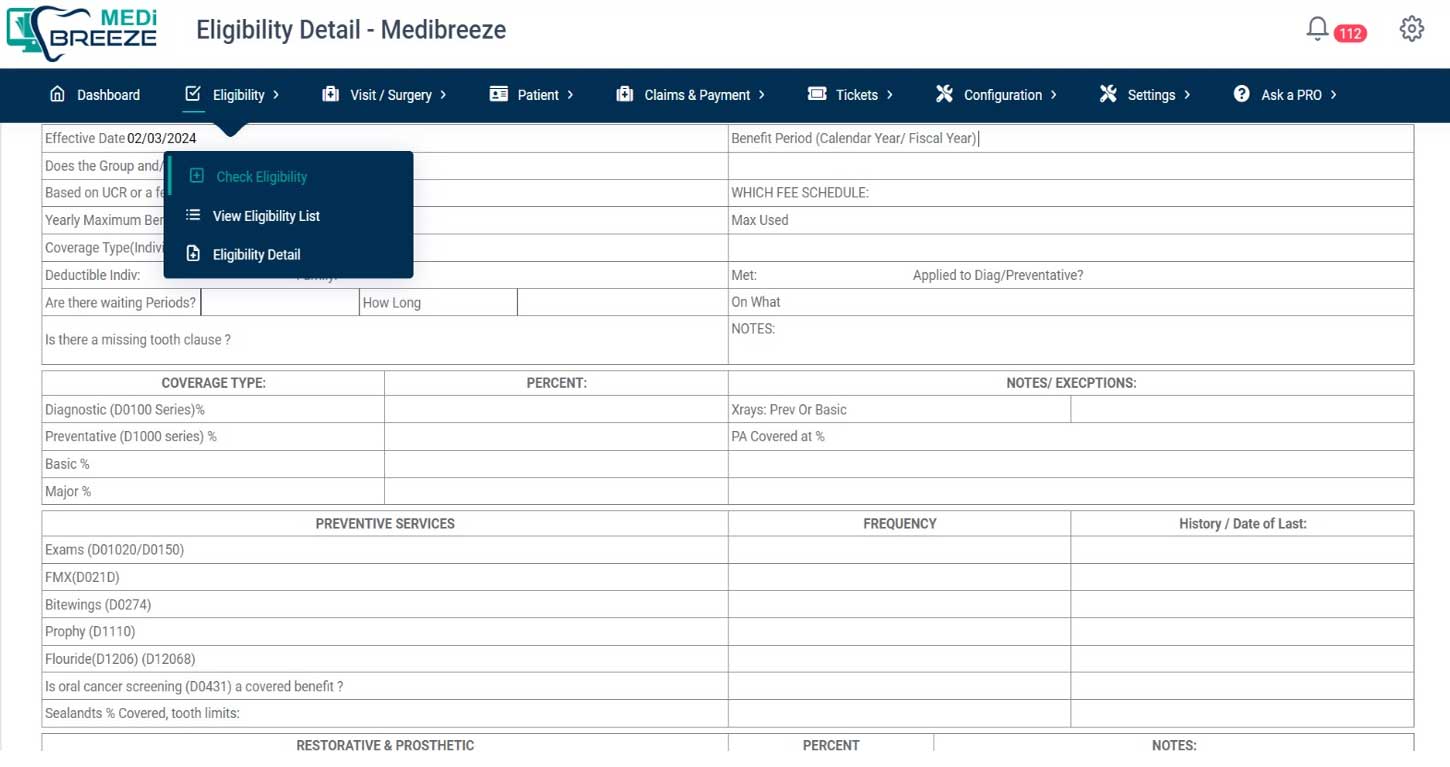

Dental Insurance Verification

MediDental is the industry leader, In the field of dental insurance eligibility verification.

"What does eligibility and benefits verification entail?"

Dental providers must confirm each patient's eligibility and benefits before the patient's visit to ensure payment for the services rendered. Reports suggest that up to 75% of claim denials result from patients being ineligible for the healthcare services provided. Regrettably, this crucial process often gets overlooked in the revenue cycle chain.

IMPACT OF INEFECTIVE PRIOR AUTHORIZATION PROCESSES AND ELIGIBILITY/BENEFITS VERIFICATION

Inefficient processes for determining eligibility, benefits, and/or prior authorization may lead to a rise in claim rejections, postponed payments, more work on rework, and delayed patient access to care, worse patient satisfaction, and nonpayment of claims.

Billing for Dental Services With the aid of MediDental, you can shorten your client's accounts receivable cycle by assembling a team of professionals. Before the patient leaves for the doctor's office, we make sure they are eligible and get the required prior authorization.

As part of the verification procedures, the following will be carried out by our team members:

- Coverage: refers to the patient's current state of insurance on the day of service.

- Benefit options include waiting periods, missing tooth clauses, and patient responsibility for copays, coinsurance, and deductibles.

- When necessary, the group will start prior authorization inquiries and secure therapeutic permission.

Charge Entry Services

The process of charging a patient's account with the appropriate amount based on the selected medical codes and associated fee schedule is known as charge entry. The charges recorded for the rendered medical services determine the reimbursements for the services of the healthcare practitioner. Errors in Charge Entry must be avoided as they could lead to more claims being denied. Save millions of dollars in lost income by adequately reviewing the medical services rendered in order to reduce revenue leakage. To guarantee that the charges recorded are correct, all procedures are invoiced for, and the codes assigned are compliant, we provide efficient coordination between the charge entry and coding teams.

The following steps are part of our process

- Superbills, charge tickets, and related clinical paperwork received through an electronic health record, document management system, or FTP server.

- recording the patient's biographical data, the date of service, the billing company, the healthcare provider who referred the patient, the Point of Service, the data and admission time, the ICD/CDT/CPT codes.

- Automation of workflows to give clients daily reports and promote cooperation to guarantee adherence to timely filing requirements.

- Before billing, the imported charges are reviewed for accuracy.

- SQC (Statistical Quality Control) to conduct a random audit to evaluate the process's quality.

- Respect for previously established, provider-specific guidelines for the various specialties and services provided.

- Daily review of all held or pending papers with the customer in order to minimize any backlog.

- In order to find any missed charges, cases of overbilling, and Dental coding problems, we also provide charge audit services.

Advantages provided by our Charge Entry Team

- Our value statement Increase efficiency and accuracy of the entry process by setting goals for our agents.

- Our coding teams frequently handle charge entry as well, depending on the billing software's capabilities.

- We offer expertise in a variety of medical fields.

- Claims filed on time with faster turnaround times because to our deep global delivery methodology.

- Continuous monitoring of denial patterns and benchmarking of fee schedules to guarantee a decrease in claim denials.

- Utilize charge auditing to maximize revenue and find lost revenue.

Dental Accounts Receivable Management Services

Our rapid follow-up services, which guarantee that you comprehend the causes behind delays in accounts receivable and swiftly follow-up with insurance companies and patients, assist healthcare providers in reducing days in accounts receivable.

Range of Services Offered for Healthcare Accounts Receivable Follow-Up

Billing for Dental Services

A group of skilled accounts receivable follow-up professionals from MediDental's staff focus on the following areas:

Contact insurance companies. To accurately ascertain the status of the claims, we interact with insurance providers using a variety of contact channels, including the website, fax, IVR, and phone. Additionally, we collaborate with end-user clients to enhance the uptake of websites as communication channels.

Create guidelines and protocols for the follow-up of A/R. We keep an eye on the A/R's aging bucket and know when the payers will have access to the data in the file. We don't waste time following up with the payers before the deadline; instead, we start follow-up calls at the appropriate number of days after the claims are submitted.

Mechanization. We have developed useful tools for generating queries, logging into the payer website, and retrieving status information on claims.

A well-thought-out action strategy. Finding out the claims' current status is not the end of our effort. We take things a step further and start filing these claims again, appealing for reimbursement, and performing analytics with the goal of lowering the number of days in accounts receivable.

Projects for Accounts Receivable Clearance

Dental Practices, hospitals, and doctors frequently encounter difficult circumstances involving aged accounts receivable (A/R). These conditions can include inadequate follow-up staff, inadequate write-off policies, inadequate closures, and other issues that result in a backlog of insurance claims amounting to millions of dollars in A/R. We undertake the clearing of the A/R backlog as one-time tasks using a very strong procedure that consists of:

Evaluation: By classifying the claims based on factors like aging, payer group, timely filing concerns, and payer kinds, we may run a claim quality analysis. This analysis aids in our comprehension of the A/R's quality, its collectability during the last clearance process, and its post-clearance valuation prior to being given to collection agencies.

Create a set of guidelines: A/R circumstances that are untidy are frequently caused by unclear policies on write-offs and insurance company negotiations, as well as by leadership changes at the healthcare provider's office and a lack of established procedures and policies. We give the healthcare provider and our billing firm clients the ability to establish collection targets, specify the negotiating procedure, and count the number of tries necessary before classifying a claim as non-collectable when we take on an A/R backlog clearance project.

Getting the Related Clinical Documentation Back: Projects to clear the A/R backlog frequently arise from underlying system modifications. The collection method may be inefficient if there is no mechanism in place for efficiently recovering clinical documentation since the related clinical paperwork might not be available.

The following advantages are provided to our clients by our comprehensive range of A/R and denial management services:

- Put your attention on resolving claims. Rather of only getting the status of the claims, we concentrate on fixing them.

- Reduce the effort required during employment. We take use of chances to minimize efforts to monitor claims status manually by increasing adoption of technologies like web portals for doing so.

- Automation of workflow. Insurance companies must provide answers to a series of questions for each claim status code in order to successfully resolve the claim. Our web-based workflow technologies have helped us define our work queues for following up on claims, which has improved the quality of the documentation.

- Metrics and Dashboards. To obtain an accurate picture of the A/R and concentrate our efforts on solutions, we produce multi-variate reports.

- Enhanced collections and decreased A/R days. Our clients report improved collections of roughly 5-7% and a 20% decrease in days in accounts receivable.

Posting Services for Payment

In many respects, the payment posting procedure offers insight into how well your revenue cycle is working. It enables you to do analytics and comprehend trends in reimbursements. Because precise payment posting provides insight into the status of your revenue cycle, selecting a highly productive workforce to handle payments is essential.

Our Process for Posting Payments

We follow the protocols established by our clients and handle various remittance kinds with enhanced accuracy and timeliness. The following services are supplied by us:

Payments to Patients. Our clients provide us with information on the point-of-service payments made by our patients. These payments, which can be made with cash, checks, or credit cards, may be necessary to cover deductibles, co-pays, or non-covered treatments. Our group examines obtained, with the same being applied to each patient account.

Insurance Posting: The following formats are used by us to process insurance payments:

- The electronic remittance advisory. Payers provide us ERAs in large quantities, which we process in batches by importing into the practice management system of the customer. Every batch run generates exceptions that leak out, which we fix in addition to double-checking the batch counts.

- Manual Posting: We frequently receive scanned EOBs from our clients. Every EOB batch is processed in accordance with the business requirements of the client for adjustments, write-offs, and balance transfers to secondary insurance companies or patients. Secure FTPs or the EHR system are used to access the batches.

- Denial Posting of claim denials is necessary in order to accurately determine the A/R cycle of the customer. The payers return denied claims with ANSI codes for denials and occasionally with payer-specific medical coding requirements. We are proficient in rejection codes that are ANSI standard and we are aware of the payer-specific codes for the majority of payers. Every time a claim is denied, we log it in the practice management system and take appropriate action, such as sending the claim for reprocessing, writing off the amount, re-billing the secondary insurance company, or transferring the balance to the patient.

Our payment posting process's advantages

Superior Quality. You may count on a contractual promise of more than 97% accuracy when working with our global delivery team, but in practice, you get more than 99% accuracy.

Adaptability. We can ensure a 24-48 hour turnaround time because our team members are working nonstop.

Gain a precise comprehension of the A/R cycle. To obtain an accurate picture of your accounts receivable situation and make informed decisions, payment posting accuracy is essential.

Analytics. We provide A/R trend reports to:

Handling of exceptions. We follow your company policies and notify you of any noteworthy developments, changes to the contract, or rejections.

Unlock the Benefits of Medicare Provider Enrollment Today

Take the leap towards expanding your practice's horizons. Let us handle the intricacies of Medicare Provider Enrollment while you focus on what you do best - delivering exceptional dental care. Contact us today to embark on a journey of growth, compassion, and excellence.